Gifts of Personal Property

Donate personal property that will help us to continue and expand our mission while providing significant tax benefits to you.

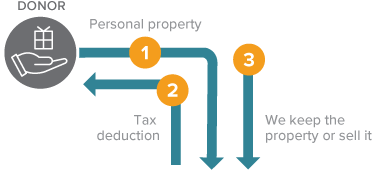

How It Works

- You transfer a valuable painting, antique, or other personal property to Reason Foundation.

- Reason Foundation may hold and display the property or use it in the furtherance of its mission.

- Reason Foundation may sell the property at some point in the future and use the proceeds for its mission.

Benefits

- You receive an immediate income tax deduction for the appraised value of your gift and pay no capital gains tax, so long as the gift can be used by Reason Foundation to carry out its mission.

- Without using cash, you can make a gift that is immediately beneficial to Reason Foundation.

Next

- More details on gifts of personal property.

- Frequently asked questions on gifts of personal property.

- Contact us so we can assist you through every step.