Gifts of Mineral Interests

Help us continue our mission by donating mineral rights through your estate or trust and receive a tax deduction.

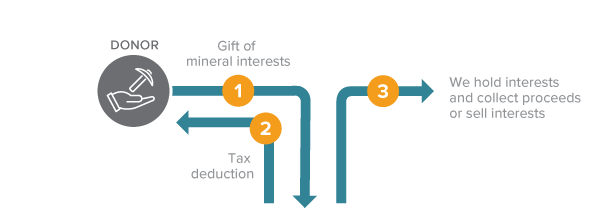

How It Works

- You donate mineral interests to Reason Foundation.

- We hold the interest and collect the proceeds, or we sell it and apply the proceeds to the purposes you designate.

Benefits

- You make a gift that benefits Reason Foundation.

- You make the gift outright or you may use it to create a life income gift that will pay you or your beneficiaries income for life.

- You are eligible to claim a tax deduction based on the mineral interest's fair-market value at the time of the gift.

- The value of the assets will be removed from your taxable estate.

Next

- More detail on mineral interests

- Frequently asked questions on mineral interests

- Contact us so we can assist you through every step.